Capital Fiduciaries to the Commercial Real Estate Marketplace.

Preserving Ownership.

Protecting Capital.

Restructuring Inteligently.

Who We Are.

A firm with over $3.0BB in transaction activity, eight economic cycles, over 200 direct capital sources, a 96% success ratio, and over 30 years of highly specialized CRE experience, we fix capital stacks on commercial real estate assets.

HAUTE Real Estate Capital is a Fiduciary commercial real estate capital advisory boutique that emerged from the existing HAUTE Commercial Real Estate brand, which has been – and remains - synonymous with the highest levels of CRE expertise, sophistication, integrity, and certainty of execution.

We serve CRE investors, syndicators, institutions, and all capital providers (debt, equity, mezzanine, and hybrid) that are facing distress, uncertainty, complexity, or transition - and deliver sophisticated capital stack re-engineering solutions, restructuring, and investor advocacy – all as a ”conflict-free Fiduciary.”

What We Do.

HAUTE Real Estate Capital steps in when commercial real estate capital breaks down, operating at the intersection of distress and discretion - serving as Fiduciary capital advisors focused exclusively on preserving and recovering value for CRE investors, lenders, capital providers, and stakeholders.

When deals stall, partnerships fracture, maturities default, or covenants fail - we bring clarity, strategy, and proven solutions.

From capital calls that can't be met to stakeholder disputes that paralyze decision-making, we navigate the most complex, time-sensitive situations with absolute precision. We advise, strategize, guide, structure, and negotiate - all while bringing clarity, options, and certainty of execution - as a Fiduciary - in carrying out your tailored CRE investment strategy.

Where distress demands expertise ...

... we deliver Certainty of Execution.

The Company.

The CRE market was severely lacking this combination of sophistication, granular attention to detail, and ethical authenticity. Until Now.

HAUTE Commercial Real Estate was originally founded by Gregory J. Laskody, a 1988 graduate (B.S., Real Estate and Finance) of Florida State University’s renowned and nationally ranked Real Estate program of the College of Business. He has been active in the South Florida commercial real estate market since that time, becoming a market leader and a local CRE and related capital markets expert.

Throughout his career, he has held production, leadership, and executive management positions with some of the most notable companies in commercial real estate, such as: Deloitte; Nomura Capital; The Capital Company of America; Wells Fargo; Q10 Capital; Newmark Grubb Knight Frank; Colliers International, and Lee & Associates.

He has also held the following commercial real estate designations, licenses, and achievements:

A licensed real estate broker (Florida)

A Certified Commercial Investment Member – CCIM - of the CCIM Institute (former)

A Member of the Appraisal Institute – MAI (former)

A licensed mortgage broker – Florida (former)

A State-Certified General Real Estate Appraiser – Florida (former)

A State-Certified General Appraisal Instructor - Florida

An Adjunct Professor of Real Estate Studies at Miami-Dade College (former)

Mr. Laskody brings a deep, diverse background in commercial real estate, offering valuable market insight and financial advisory expertise to a broad client base—including financial institutions, law and accounting firms, insurers, asset managers, government entities, investors, developers, and family offices.

He served on the Conference Committee of Florida State University’s Center for Real Estate Education (2011–2015) and has been a frequent speaker and panelist at regional and national real estate events. Greg has completed over 70 CRE courses from institutions like the Appraisal Institute and CCIM, and his work has appeared nationally in various industry publications.

Greg led the East Coast District of CCIM Florida (2020–2021) and founded the “CRE Networking Group” during COVID to help young professionals enter the South Florida CRE space, achieving over 120 members in less than one year.

He is also the Founder of www.MasterCRE.com, a global membership platform for CRE education, career resources, networking, and deal-making.

Why Boutique?

An open letter from the Principal and Founder

We think the “Why Boutique?” is a great question – and a strong consideration when choosing a commercial real estate advisor.

Boutiques are a lot like property owners – both are comprised of original-thinking entrepreneurs that can move quickly and nimbly in times of change, or when it is warranted in any imaginable situation.

Big brokerage firms simply are not, and cannot, because of:

•Corporate bureaucracy, structured systems, and company gridlock;

•Highly competitive and politically charged environments;

•Overloaded managerial structures and layers of employees and support staff;

•Greedy masses of brokers competing against each other while aggressively pushing their own agendas, with;

•All of the above resulting in a culture that is incongruent with their Clients’ best interests.

In our opinion, this is simply no way to conduct business under any acceptable circumstance.

By nature, real estate has always been – and always will be – based on local market nuances and granular insight. Over 80 percent of all commercial real estate transactions that occur nationally are handled by local, non-national brokerage firms.

The remainder are handled by institutional investors with parameters that are national in scope - requiring the continuity of a national platform from which to execute their investment strategies. These national brokerage firms succeed by having a “Point of Contact” (“POC”) that reports directly to a Client owning multiple properties across a state, country, or even the globe – and as such has specific reporting requirements and a need for local representation in each of those markets.

But … here’s the flip side in dealing with larger national firms – numbers.

Because these huge firms must maintain teams, corporate and back-office overhead, and national platforms, higher transaction sizes are required - translating to higher fees and commissions along with compromised Client service and attention. This culture results in an “all or nothing” approach, meaning that these firms will also demand a Client’s property management, asset management, leasing services, capital markets, general contracting, etc. – and, on an “exclusive” basis – because they need that fee depth to keep a large operation viable. As a result, and to close that gap, they take assignments that aren’t in the best interest of the Client, and in the process eliminate that specialized and dedicated level of service and expertise that a Client deserves, and that only a boutique can provide.

HAUTE Real Estate Capital takes a different approach, whereby the Client is never just a number. We rely on local, granular nuances and expertise. We act as true Fiduciaries to every single Client, directly, and on every aspect of the transaction – from hand-crafting every engagement, marketing plan, and negotiating the best possible capital stack structure, pricing, underwriting, and terms resulting in the fastest path to a closed, funded, and done deal matching the investment strategy – all while ensuring speed, flexibility, and certainty of execution throughout the entire process.

On behalf of the entire company, I invite you to reach out to me personally to further discuss your specific CRE capital needs and requirements. We aim for nothing less than your complete satisfaction, and we look forward to serving you as a Fiduciary in all of your commercial real estate endeavors.

Warmly,

Gregory J. Laskody

Principal and Founder

Why Us

Commerical real estate is slow to change ... but the world isn't.

With continuously rising barriers to ownership, opaque syndications, and an increasingly fractured capital environment, CRE investors are ,more vulnerable, at risk, and … totally underserved –than ever before.

HAUTE Real Estate Capital was built for this moment:

• Where real Fiduciaries are rare.

• Where institutions overlook the $5.0MM to $100.0MM CRE asset space.

• Where conflict-free advocacy is harder than ever to find.

We’ve been involved in over $3.0 billion in complex real estate transactions, experienced and worked through eight full economic cycles over the last 30-plus years, and operated across the table - as appraisers, lenders, borrowers, sponsors, and Fiduciary advisors.

Strategic Planning

Confidently navigate capital markets and complex CRE challenges with strategies tailored to preserve ownership, protect capital, and achieve your unique investment goals.

Investment Insight

Through capital stack forensics and market benchmarking, we deliver clarity that uncovers actionable opportunities aligned with your investment objectives.

Our Process.

HAUTE Real Estate Capital brings over 30 years of highly specialized and sophisticated CRE appraisal, valuation, underwriting, investment sales and realty capital brokerage, direct capital markets (private equity and private credit) and transaction structuring experience - all combined with a proprietary technology platform allowing for real-time key metrics on all critical components of any CRE transaction.

We employ the following process on every CRE transaction and for every Client.

Strategic Client Interview

What were your original investment objectives?

Where are you now – performance, structure, risk, return "of" and return "on?"

What is standing between you and your desired outcome?

Capital Stack Forensics

Asset performance vs. submarket

benchmarks

The actual capital stack, partner dynamics, and agreement structures

Ownership rights, distribution waterfalls, and fiduciary responsibilities (if any)

Capital Management and Strategies

Scenario-based asset performance vs. submarket benchmarks

The actual capital stack, partner dynamics and agreement structures

Negotiation frameworks and customized strategic playbooks to facilitate a successful

We then take the results of this highly granular research and craft a tailored "playbook" that we then submit to those capital sources most appropriately aligned with our Client's overall investment objective concerning their CRE interests.

Our Differentiators.

Here are the unmatched differentiators separating "the best" from "the rest."

Truly independent fiduciary guidance as an advocate – no brokerage bias, no hidden incentives, no agendas, and no conflicts of interest.

Highly sophisticated, detailed, and granular underwriting capabilities.

GP / LP / Syndication-specific expertise.

Deep CRE capital stack structuring experience of all capital components (debt, equity, mezz, and hybrids).

Expert guidance through both capital- and sponsor-side distress.

Highly specialized middle-market focus and expertise: $5.0MM to $100.0MM transactions too small for institutional investors, but too complex for self-management.

Direct access to senior professionals with zero bureaucracy.

Post-closing support and implementation services.

Deep lender and capital relationships that extend well beyond local banks.

Creative restructuring strategies and solutions beyond a standardized playbook.

“Technical + Relationship Approach:” combine sophisticated analytical and financial modeling with hands-on white-glove Fiduciary advisory services.

Our Experience and Expertise.

No one in the commercial real estate capital space can match our diverse and unparalleled experience.

Our years of diverse experience in appraisal and valuation; investment sales and capital markets brokerage; direct lending; private equity and private credit, and; customized client-based CRE solutions – all built upon a cornerstone set from a nationally-ranked CRE academic program, along with certifications, licensure, and professional designations that collectively less than two percent of professional CRE practitioners possess globally – all combine to give our Clients an unmatched transaction experience backed with trust.

Our Typical Client.

Our typical Client generally meets some, or all, of these criteria.

Owns or manages an interest in mid-market CRE (debt, equity, or mezz) with a minimum value of $5,000,000.

Is involved in a CRE transaction that is not operating, performing as expected, impaired, or facing imminent loss.

Experiencing actual or potential disputes and/or litigation between involved parties.

Faced with imminent restructuring, maturity or technical defaults, valuation resets, and/or capital calls.

Requiring collateral recovery, interim stewardship, and/or borrower negotiations.

Recapitalizations, GP/LP buyouts, liquidity events, forensic clarity, and/or exit strategies.

Partnership interest buyouts, capital maturity defaults, or other capital relationship challenges.

Succession planning, modernization, or other material events that could jeopardize asset ownership or the transfer of such ownership.

A recapitalization of existing assets to allow for additional acquisitions, capital retirement, or capital redeployment.

Lastly, a willingness to trust in HAUTE Real Estate Capital’s experience, expertise, relationships, and proprietary platform to control and manage the entire process.

Case Studies: CRE Capital Advisory Solutions.

Four Seasons New Orleans

Business Development Manager

Represented the sponsors to formulate the capital stack for the project, which involved an approximate $290MM construction loan with $56MM in sponsor equity; $46MM from one sponsor and an additional tranche of preferred equity. Redevelopment of this historic iconic New Orleans building was slated for a 2021 opening as the city’s only 5-star hotel. The total project renovation cost is approximately $530MM, and features 92 residences, 341 hotel rooms with full amenities, a pool, ballrooms, and a rooftop observation deck.

Four Seasons New Orleans

Strategic Capital Stack Restructuring Placement

Executed the strategic restructuring of an 18-story, 229,900 SF multi-tenant office tower built in 1966 and renovated in 2007, encumbered by a $22.4MM mortgage at 6.30%. Following direct engagement with the special servicer, we conducted a forensic NPV analysis, market study, and competitive positioning assessment. We then negotiated a $13.8MM discounted payoff - a 38% debt reduction - at a revised 6.50% rate. The result: ownership preserved, bankruptcy avoided, and $8.6MM in savings delivered, underscoring our value-add.

Islandia Shopping Center

CMBS Restructuring

Restructuring of a 376,800-square foot regional shopping center in Islandia, NY, built in 1991. At acquisition, the center was financed with a $73.6MM loan with an rate of 5.70 percent. Negotiated an “A/B Note” split at a new “A” note of $63.5MM and a new “B” (hope) note of $10.1MM, with new interest rates on the A and B notes of 4.25 percent. Negotiated with special server and provided a detailed analysis of the property’s Net Present Value (“NPV”), along with a fundamental market and supply/demand analysis resulted in this successful outcome for our Client.

Edison Retail Center

Discounted Pay-Off ("DPO")

This restructuring involved a multi-tenant retail asset located in Edison, NJ, containing 189,700 square feet, originally constructed in 1985. The acquisition was financed with a $33.10MM mortgage at an interest rate of 6.45 percent. Initial contact was established with the special servicer, and after performing a detailed analysis of the property’s NPV, along with both a fundamental market analysis and a competitive supply and demand analysis, we successfully negotiated a DPO of 50 percent, resulting in $16.6MM in savings to our Client.

Hempstead Retail Portfolio

Multi-Asset Discounted Pay-Off ("DPO")

Executed the strategic restructuring of an 18-story, 229,900 SF multi-tenant office tower built in 1966 and renovated in 2007, encumbered by a $22.4MM mortgage at 6.30%. Following direct engagement with the special servicer, we conducted a forensic NPV analysis, market study, and competitive positioning assessment. We then negotiated a $13.8MM discounted payoff - a 38% debt reduction - at a revised 6.50% rate. The result: ownership preserved, bankruptcy avoided, and $8.6MM in savings delivered, underscoring our value-add.

Case Studies: CRE Investment Sales and Capital Markets Transactions.

Aventura Commons

JV Partner Buy-Out

Structured and originated a $17,250,000 senior mortgage to refinance this 268,728 SF institutional-grade power center, enabling a strategic partner buy-out. Anchored by national tenants including Target, Best Buy, Whole Foods, PetSmart, and Ulta Beauty. Located in the high-density Aventura submarket of Miami-Dade County, FL.

Boynton Beach Industrial Warehouse

Cash-Out Refinance

Sole advisor to the sponsor in securing a $1,800,000 cash-out refinance on a 39,876 SF owner-occupied manufacturing warehouse spanning two parcels. The transaction strategically unlocked trapped equity to support further investment acquisitions in Palm Beach County, FL.

Broward Industrial

Investment Sales and Acquisition Financing

Represented the buyer in the acquisition and structured a $4,000,000 senior loan for a ±90,000 SF industrial/flex facility strategically positioned near I-95 in Eastern Broward County’s industrial corridor.

Pembroke Pines Shopping Center

Full Capital Stack Execution

Arranged both acquisition, construction, and $3,750,000 CMBS permanent financing for a 35,000 SF unanchored shopping center. The permanent loan retired a construction facility from Bank of America. Located in a growth corridor of Pembroke Pines in Broward County, FL.

Pinecrest Shopping Center

Acquisition Financing

Secured $18,500,000 in senior debt for the acquisition of a 120,000 SF grocery-anchored retail center in the ultra-affluent Pinecrest submarket of South Miami-Dade County, which is one of the region’s top-performing retail assets.

Miami Design District Showroom

Cash-Out Refinance

Executed a $6,000,000 senior refinance on a Class-A, fully leased retail showroom at the gateway of Miami’s Design District. The asset’s NNN leases were corporately guaranteed, and the restructured capital stack enabled the acquisition of additional institutional-grade assets.

Tamarac Shopping Center

Investment Sales and Acquisition Financing

Acted as the exclusive buyer representative broker and capital advisor, arranged $5,000,000 in senior acquisition financing for a 105,541 SF grocery-anchored retail center in Tamarac, Broward County, FL.

Case Studies: Multi-Family Investment Sales and Capital Markets Transactions.

Miami Mid-Rise Apartments

Investment Sales and Acquisition Financing

Exclusively represented the seller in the disposition of this asset while arranging an $8,400,000 senior mortgage involving a 254-unit mid-rise apartment community located in Kendall, Miami-Dade County. This asset was later repositioned for condominium conversion.

Coconut Grove Apartments

Investment Sales and Acquisition Financing

Exclusively represented the buyer in the acquisition of a five-story apartment building located in the heart of Coconut Grove in Miami, securing acquisition financing via a $2,550,000 CMBS senior mortgage.

Fort Lauderdale Apartments

Investment Sales and Acquisition Financing

Represented the buyer as the buyer's broker in this acquisition while simultaneously originating a $3,260,000 senior CMBS loan on this multifamily asset located in Oakland Park, Broward County, FL.

Monte Sano Apartments

Capital Stack Execution and Disposition

Arranged $11,845,000 in senior debt and $300,000 in preferred equity for a 180-unit garden-style complex in Huntsville, AL. Subsequently retained for exclusive disposition services and a successful sale of the asset.

Case Studies: Customized Client-Specific CRE Solutions.

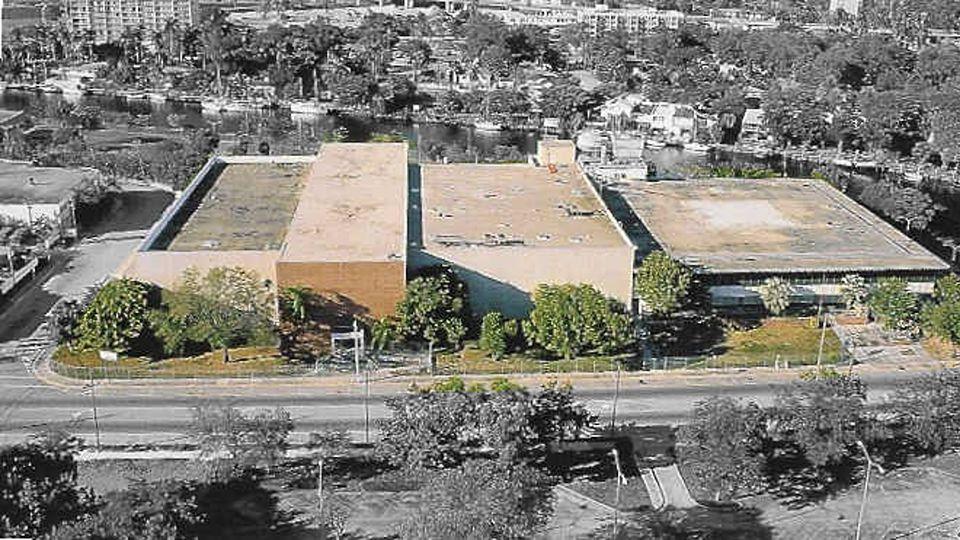

North Miami Beach Assemblage

Advisory and Disposition Strategy

Advised a global religious institution in the disposition of a strategic land asset. Engineered a joint assemblage with adjacent landowners to position the site for a transformative mixed-use redevelopment in North Miami Beach, FL.

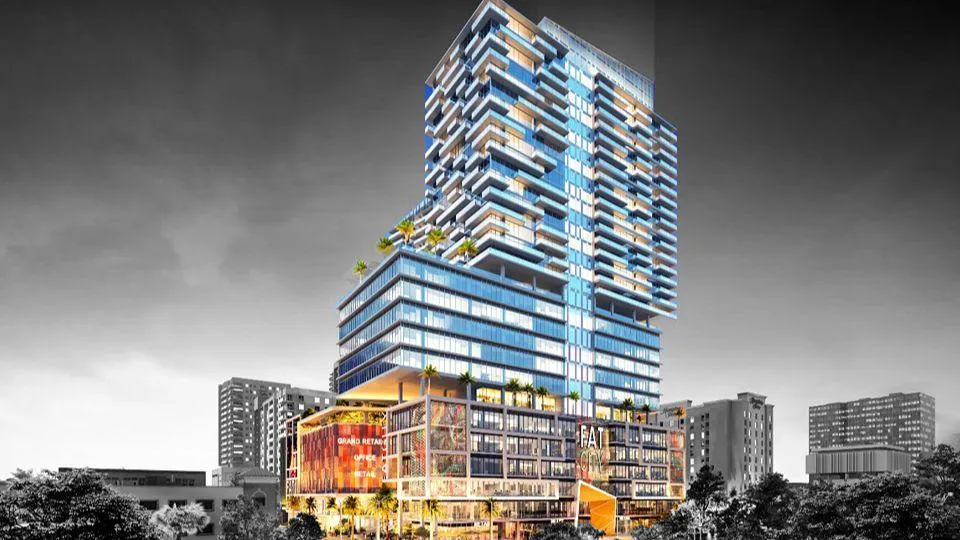

FAT City Assemblage

Acquisition, Assemblage, and Entitlement

Retained by a NYC-based developer to lead the assemblage of 9 contiguous parcels totaling 2.69 acres located within the CBD of Fort Lauderdale, FL. Secured entitlements for 1.35 million SF of mixed-use space across two 30-story towers within 18 months.

The "Miami Circle" Project

Valuation, Development Advisory, Expert Witness

Located at the mouth of the Miami River, this site was the subject of much controversy at both the state and federal level - due to the existence of artifacts dating back to the Tequesta Indians over 1,700 years ago. Initially purchased for the construction of 600 luxury residential units, the site had subsequently been condemned for its historical significance, and assisted in obtaining the owner/developer a “just compensation” settlement.

Mirador Assemblage

Acquisition Brokerage, Assemblage Advisory

Exclusively retained to assist the owner of this 17-story, 463-unit luxury high-rise rental project to increase its market advantage - while simultaneously avoiding an illegal non-conforming land use - by assembling 14 nearby parcels containing 16,800 square feet of land for the ultimate redevelopment and construction of a six-story structured dedicated parking garage.

Metropica

Valuation, Development, Capital Markets Advisory

Provided valuation and strategic capital stack advisory for a 20.85-acre, $2 billion mixed-use development in Sunrise, FL. The master plan included retail, hospitality, multifamily, office, and for-sale condos. Delivered feasibility, pricing, and absorption studies for each intended land use.

Miami Intermodal Corridor ("MIC")

Valuation, Expert Witness, Litigation Advisory

Served as expert witness and litigation support advisor in condemnation proceedings related to the Miami Intermodal Center (“MIC”) - a major transit hub modeled after “Grand Central Station” in New York City - supporting property owners through advanced market valuation strategies to complete this complex assemblage.

Miami River Center

Valuation, Adaptive Re-Use, Feasibility Advisory

Delivered a comprehensive use analysis for a historically adaptive property located along the Miami River, which had previously functioned as a print facility, banking operations center, and public school over five decades.

Bank of America Tower

Ground Lease Valuation, Cash Flow Modeling

Performed a detailed cash flow analysis and valuation incorporating a complex ground lease structure. This I.M. Pei-designed, 47-story, Class-A iconic office property sits atop a Miami-Dade County-owned garage, with the building constructed on air rights in Downtown Miami.

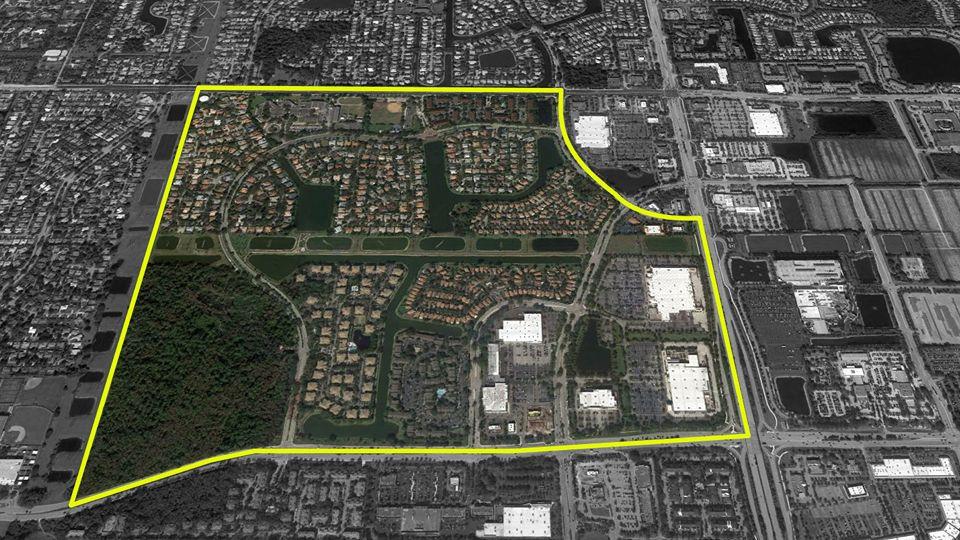

Turtle Run PUD

Comprehensive Multi-Use Property Valuation

Valued multiple land use components (residential, retail, office) situated within this 640-acre PUD developed by a joint venture between Lennar and Courtelis, located in Coral Springs, Florida.

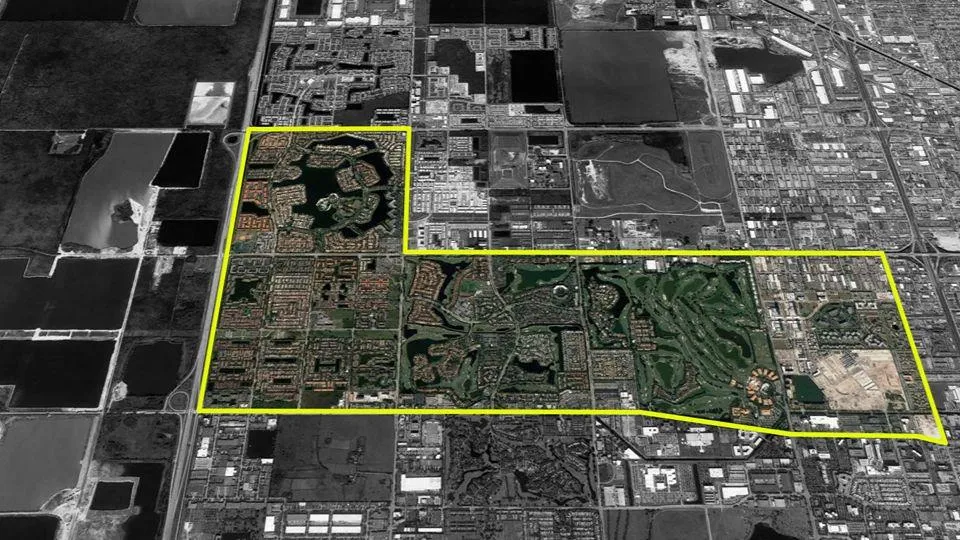

Doral Park PUD

Comprehensive Multi-Use Property Valuation

Analyzed all real estate components - including single-family, multifamily, golf, and commercial land uses – located within this 580-acre master-planned community located in Doral, Miami-Dade County, FL.

Port Everglades

Highest and Best Use Analysis

Assessed over 250 acres with varied land use and zoning classifications near Fort Lauderdale International Airport, advising on strategic disposition and development on behalf of The Swerdlow Companies and Broward County.

Arcquitectonica Building

Collateral Valuation Advisory Services

Engaged by a regional lender to evaluate a five-story, multi-tenant office property located in the South Beach submarket of Miami Beach. Designed and once owned and occupied by Arquitectonica, a global architectural firm.

Collins Avenue Retail

Mixed-Use Valuation Advisory Services

Retained by a regional construction lender to assess the potential value and performance metrics of a five-story, multi-tenant boutique mixed-use asset in the heart of South Beach in Miami Beach, FL.

The Royalton Hotel

Hospitality Valuation Advisory Services

Provided valuation advisory services on the Royalton Hotel - a circa-1920s property of historical significance, and located within the CBD of Miami. This asset was subsequently repositioned as a Travelodge.

Coconut Grove Mixed-Use Assemblage

Valuation, Assemblage, and Redevelopment Advisory

Analyzed a highly complex redevelopment site composed of retail, multifamily, and ground-leased single-family parcels - all of which were entangled by “sandwich” lease positions and other assemblage constraints.

Grove Square Condominiums

Mixed-Use Valuation Advisory Services

Retained by a regional construction lender to assess the potential value and performance metrics of a five-story, multi-tenant boutique mixed-use asset in the heart of South Beach in Miami Beach, FL.

Coconut Grove Plaza

Retail Valuation Advisory Services

Delivered a valuation and performance analysis of a one-story multi-tenant retail property situated directly south of the Shoppes at Mayfair, in the heart of the Coconut Grove area in Miami, FL.

Peacock Place

Mixed-Use Valuation Advisory Services

Provided valuation, market study, and repositioning analyses involving a four-story, multi-tenant retail and office asset located within the heart of Coconut Grove of Miami, FL.

Boca Raton Medical Campus

Adaptive Use Valuation

Valuation and performance analysis for a three-building, multi-story medical office campus located along Dixie Highway in Boca Raton, originally developed as condominiums and converted to Leased Fee operations due to shifting market conditions.

Shops at Palmetto Park

Retail Valuation and DCF Analysis

Delivered a full valuation and DCF study for this power center located in Boca Raton, and with complex ownership dynamics involving fee simple anchor tenants and co-managed inline retail spaces, with all having shared parking and cross-access agreements.

The Company

The Policies

Get In Touch

US:+01 833.982.2716 (toll-free)

+01 561.571.0676 (local)

General Inquiries

Socials

Need anything CRE?

Have any questions?

Call us!

833.982.2716

Maximize Your Commercial Real Estate Position by Working With the Best!